unemployment income tax refund calculator

Ad Free tax filing for simple and complex returns. This way you can report.

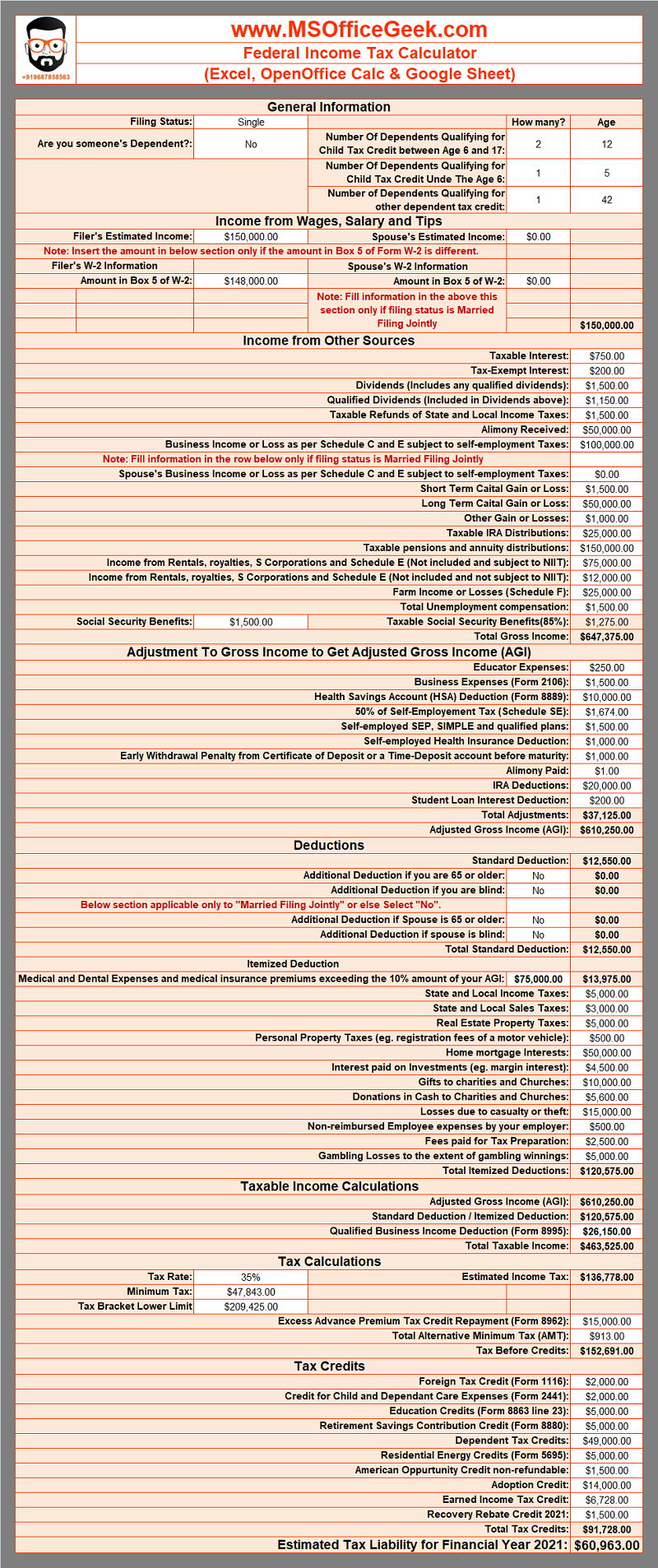

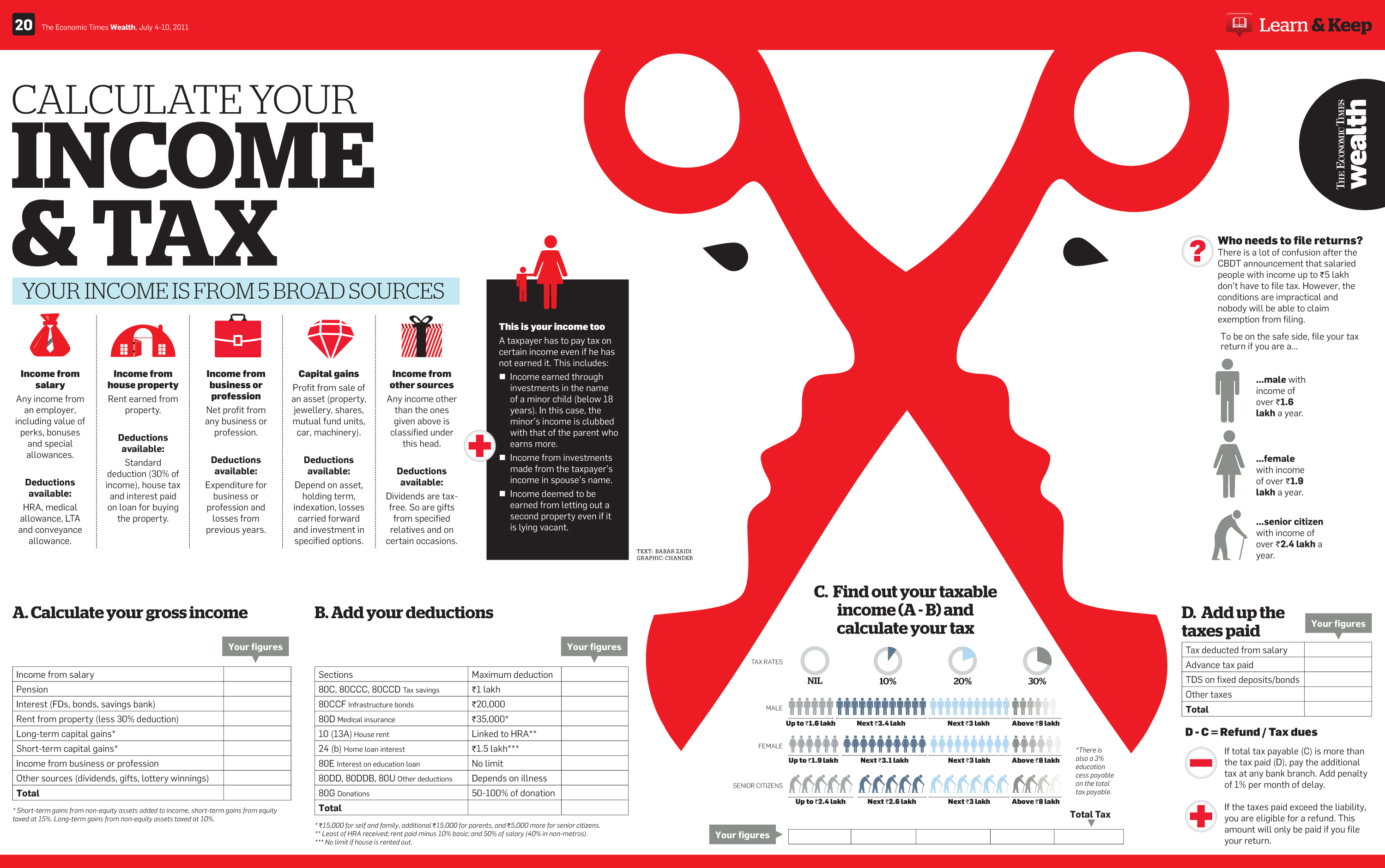

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Simply select your tax filing status and enter a few other details to estimate your total taxes.

. To calculate your weekly benefits amount you should. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. Were here for more than calculating your estimated tax refund.

Generally unemployment compensation is taxable. Even states with the more generous 26 weeks saw an increase to 39 weeks. Find pros you can trust and read reviews to compare.

Moving on to another example weve a person and they are single. Up to 10 cash back TaxSlayer is here for you. Hire An Accountant Tick The Tax Returns Off Your List.

This calculator is perfect to calculate IRS Tax Estimate payments for a given tax year for Independent Contractor Unemployement Income. Ad Need One Less Thing To Do. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Unemployment benefits are fully taxable in Maine. Premium federal filing is 100 free with no upgrades for premium taxes.

And is based on the tax brackets of 2021. Up to 10 cash back Estimate your tax refund using TaxActs free tax calculator. Use this 2021 Tax Calculator to estimate your 2021 Taxes.

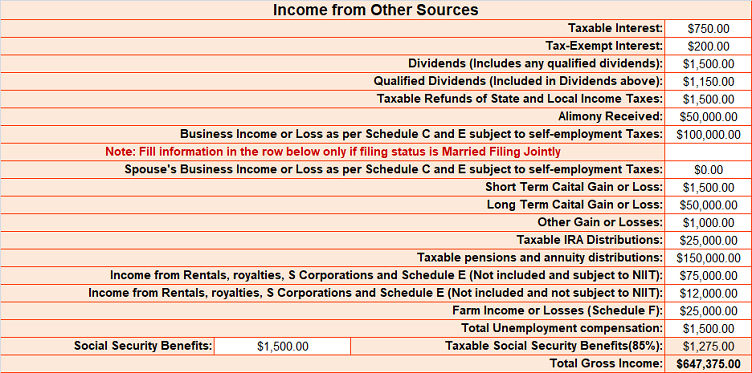

To qualify for this exclusion your tax year 2020 adjusted gross income AGI must be less than 150000. Find pros you can trust and read reviews to compare. 18 hours agoSituations that Affect Income.

Take a look at the base period where you received the highest. The unemployment benefit calculator will provide you with an estimate of your weekly benefit amount which can range from 40 to 450 per week. This Estimator is integrated with a W-4 Form.

10200 x 022 2244. This handy online tax refund. Prices to suit all budgets.

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. Unemployment Benefit Estimation Tool. The next wave of payments is due to be made at some point in mid-June but until then you may be able to work out how much you will receive.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. This threshold applies to all filing statuses and it doesnt double to.

3 of the states average. Unemployment compensation is taxable income which needs to be reported by filing an income tax return. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in.

Ad Need One Less Thing To Do. You reported unemployment benefits as income on your 2020 tax return. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. What are the unemployment tax refunds. The law waives federal income taxes on up to 10200 in unemployment insurance benefits for people who earn under 150000 a year potentially saving workers thousands of.

Work out your base period for calculating unemployment. Hire An Accountant Tick The Tax Returns Off Your List. Filing with us is as easy as using this calculator well do the hard work.

This is the refund amount they should receive. Heres what you need to know. Once you submit your.

If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Ad Real prices from local pros for any project. Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income.

Ad Real prices from local pros for any project. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. You did not get the unemployment exclusion on the 2020 tax return that you filed.

State Taxes on Unemployment Benefits. 58 on taxable income less than 22450 for single. Prices to suit all budgets.

It is mainly intended for residents of the US. So doing a little calculation gives us the following. State Income Tax Range.

Guaranteed maximum tax refund. See how income withholdings deductions and credits impact your tax refund or balance due. You should receive a 1099-G reporting the unemployment.

Individuals should receive a Form 1099-G showing.

Income Tax Calculator With Interest Top Sellers 58 Off Www Propellermadrid Com

Netherlands Income Tax Calculator Online Aangifte24

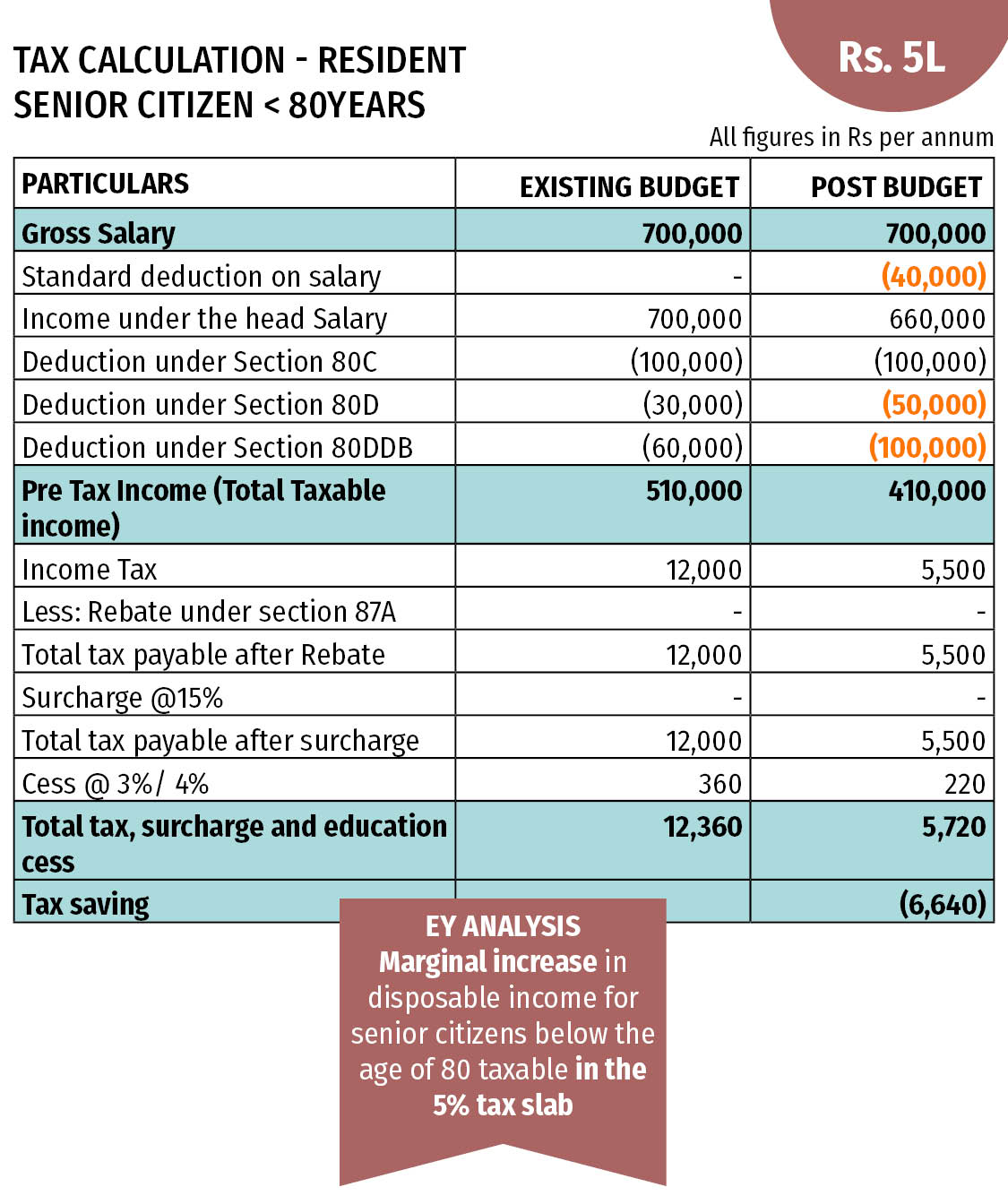

China S Individual Income Tax Everything You Need To Know

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Tax Calculator 2022 Working Out Tax Relief After 2022 Australian Federal Budget Included 1500 Lmito Payments 7news

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Calculator For India Visual Ly

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

How To Calculate Taxable Income H R Block

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Netherlands Income Tax Calculator Online Aangifte24

Refund Calculator Shop 52 Off Www Propellermadrid Com

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

China S Individual Income Tax Everything You Need To Know

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek